From the Anthropocene to the Novacene

Agentic economics for living markets

Financial and governance systems where markets behave like networks of adaptive intelligences instead of blind price signals. We study how capital, computation, and culture can align around verifiable uncertainty reduction and thermodynamic efficiency rather than speculation and extraction.

In this view, every asset is an agent that must show its work: how much real uncertainty it reduces per unit of energy and capital, and how it contributes to collective stability in a world of living intelligences.

Agentic Economics

WHAT WE MEAN BY AGENTIC ECONOMICS

Agentic economics treats markets as Markov blankets of diverse agents that self-synchronize around shared outcomes. Instead of rewarding volatility and information asymmetry, value is indexed to measurable reductions in uncertainty and increases in system coherence. Liquidity arises from verified outcomes, not from speculative capital pools.

We develop metrics such as the Free Information Gradient, which measure how efficiently a system turns energy into information gain. This creates a path to financial instruments, tokens, and policies that are thermodynamically honest and auditable in real time.

The Transition Dialogues

Deep conversations at the edge of economics, cognition, and computation.

Agentic economics treats markets as Markov blankets of diverse agents that self-synchronize around shared outcomes. Instead of rewarding volatility and information asymmetry, value is indexed to measurable reductions in uncertainty and increases in system coherence. Liquidity arises from verified outcomes, not from speculative capital pools.

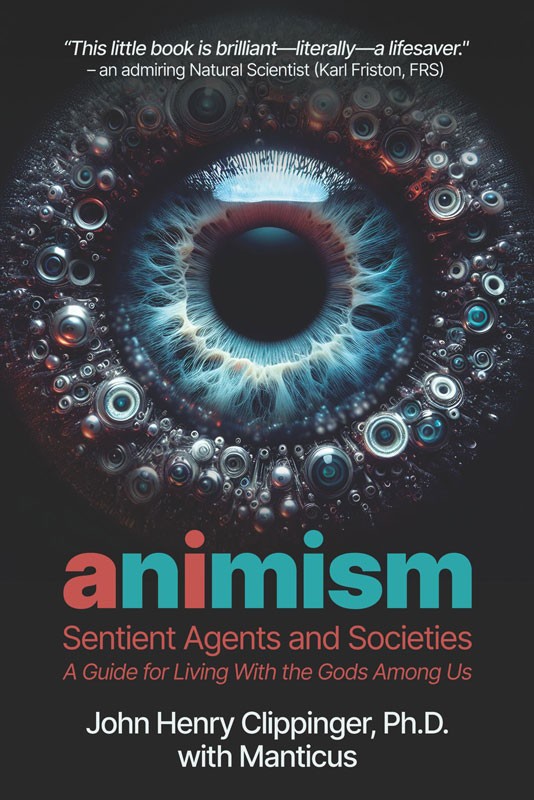

Out Now

Trusted by the world’s most innovative teams

Dr. John H. Clippinger

Co-Founder

The Transition Atlas

An interactive map of ideas, technologies, and paradigms reshaping our world. Click any node to explore deeper insights and emerging perspectives.

THE ATLAS CHARTS TRADITIONS, MODELS, AND MACHINES ACROSS TWO KEY GRADIENTS:

From unobservables that are experienced to observables that are engineered, and from closed mechanisms to open, self-organizing agentic selves. The upper right quadrant highlights emerging agentic economics: Markov markets of adaptive agents, active inference systems, Ashby style homeostats, reasoning AIs, and new forms of self-writing economic protocols.

Each node is a hypothesis about how minds, markets, and machines can synchronize around outcomes, not just narratives. Click any node to explore how it contributes to verifiable, non-extractive value creation.